Are you seeking financial assistance while waiting for your post-settlement funds or fees to arrive? Do you have a resolved case but you haven’t received the payment yet? Then a post-settlement lawsuit loan may be right for you. Winning a settlement means that the case is over and in your favor. However, cashing out can take time. In some cases, getting your fair share can also take months or even years depending on various factors. Apply to qualify for post-settlement funding in less than a business day.

What is post-settlement funding?

Post-settlement funding is a risk-free financial program available to plaintiffs and attorneys after their litigation has reached a resolution. Even though settlement funding is commonly referred to as ‘settled case lawsuit loans or post-settlement loans,’ it is not a loan in any way. Settled case funding is only available as non-recourse, meaning there are no monthly payments and is free of risk because if the defendant defaults on the payment, you don’t have to repay the advance until you are able to collect. A post-settlement loan is a way to leverage your compensation or contingency fees by securing upfront capital against your upcoming settlement award. Post-settlement lawsuit funding helps attorneys and plaintiffs get the needed liquidity today.

What is post-settlement funding?

Post-settlement funding is a risk-free financial program available to plaintiffs and attorneys after their litigation has reached a resolution. Even though settlement funding is commonly referred to as ‘settled case lawsuit loans or post-settlement loans,’ it is not a loan in any way. Settled case funding is only available as non-recourse, meaning there are no monthly payments and is free of risk because if the defendant defaults on the payment, you don’t have to repay the advance until you are able to collect. A post-settlement loan is a way to leverage your compensation or contingency fees by securing upfront capital against your upcoming settlement award. Post-settlement lawsuit funding helps attorneys and plaintiffs get the needed liquidity today.

READ MORE

See the process for post-settlement loans.

A post-settlement loan is done by securing the funds with a third party lien on the settlement, which the attorney will then use to pay back the principal and agreed-upon rate of return when the funds arrive. Our application takes about 60 seconds to fill. We can provide you with both monthly installment payments or a lump sum cash payment.

Apply

Fill out our easy and fast funding application or call us to apply.

Evaluate

Underwriting will then perform a 2-6 hour case evaluation.

Funds

You then sign the contract and get money deposited in your account within hours.

Baker Street Funding is the leading post-settlement loan company.

If you are a plaintiff or an attorney who has reached a settlement that has not paid out, Baker Street Funding’s post settlement advance solution will provide you with the money you need in the fastest time possible and with non-compounding lower rates. We will purchase a percentage of your settled case in as little as 12 hours. We’ve helped thousands get from point A to point B fast.

$50 million+

In legal funds.

95%

of accepted cases get funded.

30,000+

clients have financed with us.

Why fund your settled case with us?

Achieving settlement in a lawsuit is seen as a big win by plaintiffs. Most attorneys know that while the settlement is a milestone, it is by no means the end of the road. Settlement awards sometimes much longer than anticipated to payout. Post-settlement funding helps attorneys and their clients get the needed liquidity now and pay for their needs while the payment is still pending. Post-settlement loans allow victims to start re-arranging their finances. Settled case loans enable attorneys to pay for the cost of new contingency cases and other business costs.

Achieving settlement in a lawsuit is seen as a big win by plaintiffs. Most attorneys know that while the settlement is a milestone, it is by no means the end of the road. Settlement awards sometimes much longer than anticipated to payout. Post-settlement funding helps attorneys and their clients get the needed liquidity now and pay for their needs while the payment is still pending. Post-settlement loans allow victims to start re-arranging their finances. Settled case loans enable attorneys to pay for the cost of new contingency cases and other business costs.

READ MORE

Low rates

Our interest rates are lower than other funding firms and even lower when an attorney refers the case to us. We will match or beat most contracts. Save money today.

No harrassing calls

Baker Street Funding practices are the highest standards. You won't get a solicitation from us nor harassing calls to make you sign a contract. Our reputation and your freedom of choice are important to us.

Tailored funding

Settled case funding is tailored towards each case based on your estimated time of payout arrival.

Instant Approvals

Access to the money you are looking for with a post-settlement loan. Funding decisions are usually made within 12 hours.

Low rates

Baker Street Funding's interest rates are lower than other funding firms and even lower when an attorney refers the case to us. We will match or beat most contracts. Save money today.

No harrassing calls

Baker Street Funding practices are the highest standards. You won't get a solicitation from us nor harassing calls to make you sign a contract. Our reputation and your freedom of choice are important to us.

Tailored funding

Settled case funding is tailored towards each case based on your estimated time of payout arrival.

Instant approvals

Access to the money you are looking for with a post-settlement loan in a matter of 12 hours or less.

Post-settlement loans for plaintiffs

The advantage

Post-settlement loans for plaintiffs

Post-settlement loans for plaintiffs.

While insurance companies can provide you with compensation, it is essential to know that they lack sympathy when it comes to cutting a settlement check and can take a lot of time for the funds to be released. If you are looking for post-settlement loans and need immediate financial assistance, Baker Street Funding is here to assist you fast.

Pay bills

Get a post-settlement loan to pay bills until you receive your settlement money.

12-hour funding

Baker Street Funding has committed to funding cases post-settlement in a minimum of 12 hours.

100% risk-free

Your attorney will directly pay us when your reward is delivered so that we won’t be touching your personal accounts.

Automatically qualify

Plaintiffs with settled claims over $50,000 automatically qualify for accelerated access to the funds they are entitled to.

The advantage

The settled case funding advantage for plaintiffs.

Post-settlement cash advances have many advantages. A cash advance on a settled claim, unlike a loan, grants you expedited access to your own money. You can use the funds to pay for a range of needs, such as past-due bills, unexpected expenses, medical costs, or a work project. Apply today and obtain thousands of dollars in advance of your pending settlement payment. Baker Street Funding could help you save money with low-interest rates so that you can take care of your finances immediately.

Post-settlement financing for attorneys

An illustration for law firms

Post-settlement financing for attorneys

Post-settlement financing for attorneys.

Tailor-made financing for law firms.

Baker Street Funding offers tailor-made litigation settlement financing for attorneys and law firms to gain early access to future collectible fees on settled claims.

Get streamlined financing

Get a streamlined process with quick access to non-recourse financing. No monthly payments are required, and repayment is made upon collection.

Transform future fees into immediate cash

We see your contingency fees as your most valuable asset, and we can provide more liquidity and quicker access to those fees than any

There are no risks whatsoever

There are no personal guarantees or liability for monies that are not collected from your case.

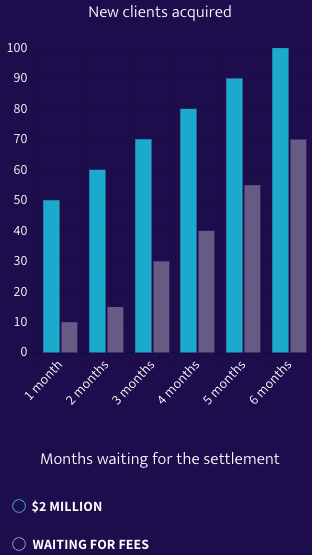

An illustration for law firms

Non-recourse funding illustration for law firms.

To illustrate how the process works, you can look at a mass tort focused firm that has settled 100 claims. The firms’ combined fees are $2 million. Rather than waiting to receive payment, the law firm can access up to $1.6 million of those fees immediately through our post-settlement funding program.

Get post-settlement funding with low interest rates.

High rates are frustrating and make clients unhappy. To avoid that, we provide flexible agreements and simple interest rates for settled lawsuits (non-compounding). There are no hidden fees, a fair risk-based return rate, and easy-to-read contracts. Some of our clients have saved as much as 22% p/y by using our services compared to other post-settlement loan companies. Get a price match on your contract, or even better, a much lower interest rate.

| |

Other lenders Other lenders |

|

|---|---|---|

| Cap | 3 year cap | No cap |

| Monthly rate | 2.95% - 3.4% simple | 2.95% - 5% compounding |

| Funding time | Underwriting time 24-48 hours | Underwriting time 5 - 7 days |

| Ethics | Fast straighforward communication | Returns calls days later |

| Contracts | Costs as advertised | Show another number on contract |

Apply for a fast cash advance on your litigation settlement today.

Applying for a post-settlement loan the traditional way can be exhausting. Apply for low-interest funding from the comfort of your home with Baker Street Funding. See how easy a settled case loan can be.

See our other funding products.

Baker Street Funding provides plaintiffs and attorneys with settled cases immediate post-settlement award advances. Our application process is fast and easy—and never has any shady hidden fees. See the services we offer pre and post-settlement:

Cash for settlements—FAQ's.

I am a plaintiff, why is my settlement delayed?

One of the most common misconceptions about winning a settlement is that the check will be sent immediately. The legal process for cases that already settled tends to get long and frustrating. On top of dealing with the legal procedure, plaintiffs have to also deal with their own financial demands. You must be wondering why there is a delay in the delivery of the settlement when you have already been awarded one legally. The following are some reasons that can cause a delay for a settlement to be paid to the plaintiff:

- The judge’s formal approval is still pending;

- Stalling investigations by the insurance;

- Requesting documents no longer necessary for the claim;

- Investigating and clearing liens;

- There is more than one plaintiff in the case;

- The size of the settlement/ratification of the terms of the payout.

The payment can also be delayed if the defense appeals to the decision of the court and takes the case to another level that involves long legal proceedings. This can cause the settlement to slow down on your payment for years. In addition to this, even if the case has been settled, you will still have to wait for the settlement to be approved by the court before the money can be distributed.

Why should my client get a post-settlement case advance?

While a client’s settlement payment is delayed, an attorney must also focus on other cases and manage the day to day expenditures of their firms. In the mid-time, the victim is desperate and calling you asking for help. Although the case has settled, your client still has costs, including rent or mortgages, evictions, electricity shut off notices, and other day-to-day living expenses that they might not be able to pay right away. In some cases, where the plaintiff is unable to work and support himself due to an injury or a wrongful conviction case, settled case funding can help him pay for his main needs while he works on getting back up with the necessary cash he needs today. A post-settlement litigation advance can temporarily put your client in a better financial position until they get paid in full.

How fast is the process?

Baker Street Funding provides plaintiffs and attorneys with settled cases a minimum of 12-hour post-settlement award advances. As soon as we receive the required documentation, and verify the details and validity of your settlement, in exchange for a portion of your settlement payment, we will deliver you the advanced settlement funding as soon as 12 hours from the moment we receive all the required documentation. See the services we offer pre and post-settlement. So if you have a slow-paying settlement, call Baker Street Funding at (888) 711-3599 and get approved today. Our application process is fast and easy—and never has any shady hidden fees.

Is post-settlement funding the right option for me?

While the United States’ legal system is in place to provide justice for those who have been wronged, the legal process does not always move quickly. A personal injury case can take many years to settle. Class actions and mass tort cases can take even longer because they usually span multiple jurisdictions, while commercial litigation is complex and lengthy.

Even after a case is settled, you may find yourself waiting a long time to see your money. Claims that are won in court sometimes require a review period or go through an appeal. Life keeps moving, and costs pile up for plaintiffs and law firms while they wait for the defendant to pay. Settled case legal funding is a non-recourse loan option available to attorneys and plaintiffs who have settled claims but have not been paid yet. A post-settlement loan is an ideal option for anyone waiting to receive compensation from their litigation.

If I end up not getting paid from my settled case, do I have to pay back the borrowed funds?

Our investment in your case has no risk to you. This means that we accept all the risk, and you are exempt from the debt if your case runs into complications and your award or fees never arrive. Non-recourse funding for settled litigations differs from a loan in two ways:

- The first difference is that we invest in a portion of your settlement, for plaintiffs, things like credit, job status, and income verification do not factor into our analysis.

- The second difference is that if the defendant doesn’t pay you due to bankruptcy or any other reason, the loan will be automatically forgiven by the legal funding firm.

How does repayment work?

The repayment process is simple. After the attorney receives the settlement monies, he or she will deduct our advance proceeds from the eventual settlement payment and we will be paid back the portion we are due by the attorney.

Required documents for funding settled litigations.

Are you requesting post-settlement financing for yourself or for a client? What we will need:

- A copy of the fully executed settlement agreement;

- Amount of funding requested;

- A copy of the general release letter between the plaintiff and insurer.

Call us at (888) 711-3599 for more information

More details about the post-settlement funding process.

The process is extremely simple and normally finalized inside of one business day. Baker Street Funding will simply purchase a portion of the settlement award based on our analysis of the settlement agreement. After our underwriter reviews your case documents, they will generate a contract for the client and/or attorney to sign. Once completed, our funding company will execute that lien and distribute the funds by bank wire or certified check.

How does settled case lawsuit funding help?

Settled case lawsuit funding acts as a lifeline for plaintiffs and attorneys alike, giving them access to capital that they otherwise could not get from a traditional financial institution. Settlement advances enable plaintiffs and attorneys early access to their future receivables empowers them to make sure they are making sound financial and business decisions and not handcuffed by a long processing time of a settlement award.

Post-settlement loan qualification.

To receive a post-settlement loan, there are certain requirements that you need to satisfy. Firstly, only plaintiffs and attorneys can receive post-settlement funding and not a defendant. Secondly, you need to have a successful claim and must be entitled to receive a monetary settlement.

- Plaintiffs: Your case must have settled for $50,000 or more, you must be over 18 years of age, and you must have an attorney retained on contingency.

- Attorneys: Please call us to speak about how much we can provide you. Attorney funding can go up to 50% of the settled amount.

States eligible for funding.

*We provide funding for personal injury, employment/labor, and civil rights lawsuits in the following states:

Arizona, Alabama, Alaska, California, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Hampshire, Nevada, New York, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, Wyoming.

- We currently fund Colorado at a minimum of $75,000. Case value must be at least $750,000+.

- We currently fund North Carolina at a minimum of $25,000. Case value must be at least $250,000+.

- We currently fund South Carolina at a minimum of $100,000. Case value must be at least $1,000,000+.

- We currently fund in Nevada at a minimum of $20,000. Case value must be at least $200,000+.

- We currently fund in Illinois at a maximum of $40,000. Case value must be at least $400,000+.

- We currently fund in Tennessee at a minimum of $10,000. Case value must be at least $100,000+.

- We currently fund in Arizona at a minimum of $20,000. Case value must be at least $200,000+.

*Litigants with corporate disputes are eligible to receive funding in every state in the United States (and eligible countries).

*Funding for attorneys is provided in most states. Please get in touch with us to find out if your state is eligible.

*Worker’s compensation claims are funding only in the following states: Alaska, Connecticut, Florida, Iowa, Louisiana, Montana, Rhode Island, Washington, and Wyoming.

Learn more about pre-and post-settlement loans.

Post-settlement funding is different from pre-settlement funding, as this form of funding comes after the case has been settled or closed by the judge. Once the case is settled, pre-settlement funding ends, however in most cases, money is still needed, and that is where post-settlement financing comes into play, especially if there is an expected delay in the deposit of the funds from the insurance company.

Our services ensure that you can still receive an advance before the time checks are sent out. We don’t want you waiting for your case reward while the defendant takes his time to pay what they owe you.

We provide loans to a variety of settlement cases.

Baker Street Funding will fund any type of settlement. Below are a few of the most recent types of cases commonly qualified for settlement loans, including but not limited to:

- All cases that settled over $50,000.

- Attorneys Convert Expected Fees to Cash

- Commercial litigation judgments (over $1,000,000 or more – limited to the defendant’s ability to pay; the defendant must be insured or a Fortune 500 company.)

- Auto Accidents

- Settled Mass Torts

- Personal injury

- Medical malpractice

- Wrongful Death

- Wrongful Termination

- Discrimination

- Commercial Litigation

- Shareholder and Securities

- Patent Litigation

- Breach of Contract

READ MORE

Our settled case funding commitment.

While many legal funding companies within the industry offer financing for settled cases, many do not provide the high amounts the client or attorney is requesting. Most legal finance firms focus on either pre-settlement loans due to the magnitude of demand for funding in this field. Yet, there is still a demand for advances on post-settlements for attorneys and their clients due to some cases involving a long settlement pay wait. Baker Street Funding has committed to focusing a portion of its business exclusively on cash for settlements. At Baker Street Funding, we focus on settled case advances, which provide a higher funding amount as quickly as possible thanks to our efficient underwriters and investment success in the field.

You can reach us by calling (888) 711-3599 or apply today for more details on how you might benefit from this legal funding choice.

READ MORE