Accident stats in Georgia

The Atlanta metro area is a transportation hub with several suburban community streets, hundreds of heavily traveled roadways, and six significant interstates.

While road systems well developed ensure convenient traveling, statistics show they, in fact, present severe dangers.

Even the most law-abiding, conscientious pedestrian or motorist could fall victim to disastrous occurrences. The fact is that we can’t control people’s actions, and recklessness or negligence is one of the major causes of accidents in Georgia.

Throughout the Empire State of the South, over 60 people are involved in an auto accident every hour. If these stats seem alarming, you might find it interesting to know that about 1000 drivers each day are involved in accidents.

According to the department of transportation in Georgia, the statistics below speak volumes about the number of accidents encountered every year:

- The average number of fatalities connected to auto accidents: is 1,720.

- The average number of victims injured in car accidents: is 133,000.

- The average number of car accidents every year: is 343,524.

- The average number of car accidents every day: is 1,100.

The most dangerous roads in Georgia are (including I-75, I-20, and I-85):

- Mike Padgett Hwy, Augusta

- Houston Rd., Macon

- Martin Luther King Jr. Dr. SW, Atlanta

- Wesley Chapel Rd., Decatur

- Old National Hwy., Atlanta

- Lee St. SW, Atlanta

Personal injury lawsuits

The Peach State is known for its unique landmarks; some of these landmarks include:

- Fort Frederica National Monument.

- Calhoun Mine

- Flannery O’Connor Home.

- Tybee Island Light.

- Stone Mountain.

- College Hill.

- The Guidestones.

- Consolidated Gold Mine.

- Atlanta Botanical Garden.

As Georgia is unique with its friendly landmarks, its laws are also friendly to accident victims, and they do not restrict the damage cap limit for suffering and pain.

A wide variety of factors might be provided to the jury or judge to obtain the highest possible sum.

The considerations are as follows:

- Treatment and medical bills involved

- Limitations of movement

- Emotional and mental distress

- Physical injuries (broken bones, brain damage, wrongful death)

- The loss of capability to hold employment and earn wages

- Inability to participate in day-to-day activities

- Interference with daily life

Not all the considerations above are needed to recover from suffering and pain damages.

However, these factors listed above can be enough to qualify for legal funding.

The statute of limitations

The statute of limitation for personal injury in Georgia is two years.

This 2-year cap simply means that you must file your lawsuit within that timeframe; otherwise, you won’t recover for your damages.

The insurance company

Georgia is a modified comparative negligence state. This is a modified form of comparative negligence. This means that if you are equal or more than 49% liable for your injury, you won’t be collecting any damages. The award will be reduced by the percentage that you are at fault.

The minimum auto insurance policy limits in Georgia are 25/50/25:

- $25,000 bodily injury liability per person,

- $50,000 bodily injury liability per accident,

- $25,000 property damage liability per accident.

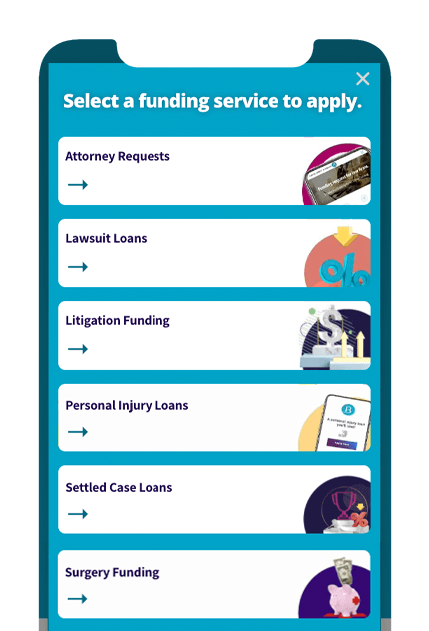

The legal funding company

It is a known fact that insurers can take years to settle cases, which helps them maximize their profit margins and forces plaintiffs into lower settlements.

Legal funding in Georgia, however, can help you get a better compensation or award for your damages, so you don’t fall victim to the insurance company’s tactics that not only make you wait long periods of time to offer a monetary recovery but the money they offer is undervalued.

Non-recourse funding is helpful for people who have financial concerns or emergency expenses while involved in litigation.

This type of financing can help Georgians reject the insurance company’s low ball offer so people can support themselves while fighting to get a fair settlement for the claim.

Georgia counties we have funded so far

- Baker

- Fulton

- Gwinnett

- Clarke

- Cobb

- DeKalb

- Irwin

- Chatham

- Clayton

- Cherokee

- Henry

- Lamar

- Forsyth

- Morgan

- Newton

- Towns

- Richmond

- Wilcox

Georgia cities we have funded so far

- Atlanta

- Columbus

- Augusta

- Savannah

- Athens

- Sandy Springs

- Roswell

- Johns Creek

- Warner Robins

- Albany

- Alpharetta

- Marietta

- Smyrna

- Valdosta

- Dunwoody

- Newnan

- Gainesville

- Milton

- Mableton

- East Point