Car Accident Settlement Advances: Overcoming Financial Hardship After a Crash

How car accident victims are affected after a car crash.

Car accidents often leave victims facing severe injuries and financial difficulties. Settling a motor vehicle accident case can take years, putting added pressure on those struggling to pay for essentials like food, rent, and medical care. This leads many to consider accepting lower settlement offers from the insurance company out of necessity.

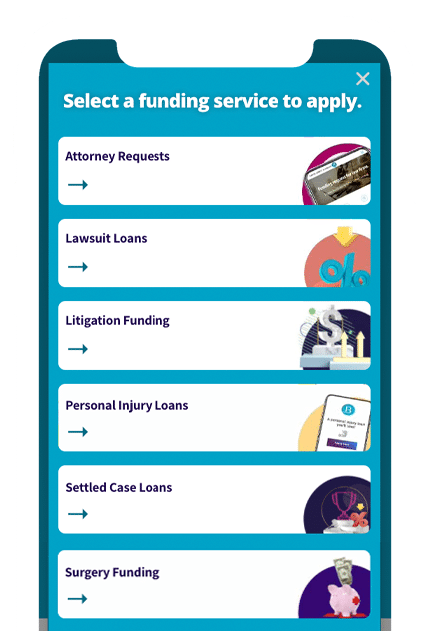

Why Pre-Settlement Car Accident Loans Are Available

Pre-settlement loans for auto accidents offer a solution for plaintiffs dealing with these financial challenges. By providing a cash advance against your lawsuit, legal funding helps you cover expenses while waiting for a fair settlement. The underwriting team reviews your case carefully to ensure it has the potential to succeed, meaning repayment is only required if you win.

Is a Car Accident Loan Right for You?

Before applying, ask yourself these questions:

Are your injuries making it impossible to work?

If your accident has left you unable to earn income, a car accident lawsuit loan can offer much-needed financial relief. However, this option should be considered only if other alternatives are unavailable. If you can manage without, waiting for your case to settle might be wiser.

Is the insurance company stalling your settlement?

If you’re stuck in prolonged negotiations and falling into debt due to delays, a car accident loan can keep you afloat while you wait for a better settlement offer. However, if you’re financially stable, it’s better to hold out for the best possible outcome.

Why Consider a Car Accident Settlement Loan?

A car accident pre-settlement loan allows you to stay financially secure without rushing into a low settlement. With quick approval and no repayment unless you win your case, it offers a way to handle your expenses during this critical period.

Car Accident Lawsuit Funding: Case Evaluation and Approval Process

1) Case Evaluation

At Baker Street Funding, we quickly evaluate your car accident case details. Our experienced underwriters, specializing in motor vehicle claims, will evaluate its potential value and merits with your attorney.

Most car accident cash advance requests are approved within 24 hours of receiving your case file. In many cases, approval happens as soon as we speak with your attorney.

2) Approval

The amount you’re approved for depends on factors like:

- The nature and severity of your injuries.

- Who was at fault.

- Case complexity.

- Insurance limits.

- Whether your case may go to trial, which can increase risk.

3) Approved Bodily Injuries

Injuries that typically qualify for funding include:

- Head and brain injuries.

- Neck and back injuries.

- Amputations.

- Burns.

- Soft tissue injuries and broken bones.

- Herniated discs.

- Disfigurement and scarring.

- Wrongful death.

4) Pre-Settlement Cash

Once we determine the value of your case, a car accident loan expert will contact you. For pre-settlement accident lawsuits, cash advances are capped at 10% of your case’s value, while settled claims can receive up to 20% of the settlement amount.

If you choose to move forward, we’ll prepare a settlement funding agreement for you and your attorney to sign. After both parties execute the agreement, we’ll send your funds by check, wire, or directly to your attorney’s office.

*** When you receive your car accident loan funds, rest easy knowing your loan is backed by your expected compensation. If your lawsuit succeeds, your car accident loan will be repaid from the recovery. And if it doesn’t go your way, you won’t owe anything—there are no obligations.

Wondering if you can get approved for car accident lawsuit funding?

Apply for an auto injury loan today or call us at (888) 711-3599 to see how we can help you get the cash you need while your case gets resolved.

How Insurance Affects Your Car Accident Lawsuit

When pursuing a car accident lawsuit, insurance plays a key role in determining your settlement. That’s why settlement funding companies, like Baker Street Funding, always request the defendant’s insurance policy. The value of your case depends on state-specific insurance regulations, which can impact your compensation.

Key Insurance Regulations That Impact Your Settlement:

- Pure Contributory Fault: Under this rule, if you’re even partially at fault, your compensation is reduced. For example, if you’re found 92% at fault, you can still recover 8% of your damages from the defendant’s insurance.

- 50% Modified Comparative Fault: If you’re 50% or more at fault, you cannot claim compensation. If you’re less than 50% at fault, you can still recover damages, but they will be reduced by your percentage of fault.

- 51% Modified Comparative Fault: If you’re 51% or more at fault, you cannot recover damages. If your fault is below 51%, you can seek compensation even if you were partially to blame.

- Uninsured Motorist Claim: This covers your damages when the at-fault driver doesn’t have insurance.

- No-Fault Insurance: In no-fault states, insurance covers medical expenses regardless of who caused the accident, but personal injury protection (PIP) won’t cover pain and suffering. Drivers in these states also face restrictions on suing other drivers.

How Pre-Settlement Funding Helps Your Settlement

Insurance companies often aim to settle for the lowest amount possible. Car accident victims, facing financial pressure from medical bills, rent, and lost income, may feel forced to accept these low offers.

Pre-settlement loans offer a solution that allows you to take care of your finances and wait for a fair settlement. This is why insurance companies typically oppose legal funding—they know that car accident plaintiffs with financial backing are less likely to accept undervalued offers.

Get the Financial Relief You Need to Focus on Recovery.

Apply for a car accident loan today and get the money you need to wait for the compensation you’re entitled to.

Causes of Auto Accidents and Common Injuries

Motor vehicle accidents are the leading cause of personal injury cases in the USA. In most cases, accidents occur because a driver was not following traffic rules, making them liable for the injuries they caused. However, in “no-fault” states, drivers must seek compensation through their own insurance unless the accident results in serious injuries.

Every year, emergency rooms treat about 2.5 million Americans injured in car accidents. Auto accidents are responsible for $18 billion in lifetime medical costs, with over 1,000 people suffering life-changing injuries daily. Additionally, more than 33,000 fatalities occur each year in motor vehicle accidents, according to the National Safety Council (NSC).

Leading Causes of Auto Accidents:

- Drinking and driving

- Texting or using a phone while driving

- Speeding

- Falling asleep at the wheel

- Poor road conditions

Common Injuries from Motor Vehicle Accidents

Car accidents can cause severe injuries that may have lasting effects, such as chronic pain, job loss, or permanent disability. These life-altering consequences are why many plaintiffs turn to auto accident lawsuit loans to cover essential expenses while awaiting a settlement.

The most common injuries include:

- Whiplash and other neck injuries

- Spinal cord injuries and back trauma

- Concussions and other head injuries

- Knee, ankle, and leg injuries

- Brain injuries and nerve damage.

Eligible States for Auto Accident Legal Funding

Baker Street Funding offers settlement loans to car accident claimants in the following states. Please note, we have minimum funding amounts in certain states as per our company policy.

Auto accident loans are available exclusively within the United States.

*We provide funding for personal injury, employment/labor, and civil rights lawsuits in the following states:

Arizona, Alabama, Alaska, California, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Hampshire, Nevada, New York, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, Wisconsin, Wyoming.

- We currently fund Colorado at a minimum of $75,000. Case value must be at least $750,000+.

- We currently fund North Carolina at a minimum of $25,000. Case value must be at least $250,000+.

- We currently fund South Carolina at a minimum of $100,000. Case value must be at least $1,000,000+.

- We currently fund in Nevada at a minimum of $20,000. Case value must be at least $200,000+.

- We currently fund in Illinois at a maximum of $40,000. Case value must be at least $400,000+.

- We currently fund in Tennessee at a minimum of $10,000. Case value must be at least $100,000+.

- We currently fund in Arizona at a minimum of $20,000. Case value must be at least $200,000+.

*Litigants with corporate disputes are eligible to receive funding in every state in the United States (and eligible countries).

*Funding for attorneys is provided in most states. Please get in touch with us to find out if your state is eligible.

*Worker’s compensation claims are funding only in the following states: Alaska, Connecticut, Florida, Iowa, Louisiana, Montana, Rhode Island, Washington, and Wyoming.

Complete List of Motor Vehicle Accidents We Fund

Baker Street Funding provides legal funding for any type of motor vehicle accident lawsuit.

The following list contains some of the claims we mostly invest in:- Ambulance accidents

- Aviation accidents

- Bicycle accidents

- Boating accidents

- Bus accidents

- Crane accidents

- Commercial vehicle accidents

- Firetruck accidents

- Forklift accidents

- Golf Cart Accidents

- Head-on accidents

- Helicopter accidents

- Hit and Runs

- Limousine accidents

- Motorcycle accidents

- Multiple-vehicle Accidents

- Pedestrian accident

- Police car accidents

- Parking lot accidents

- Racing car accidents

- Rear-end accident claims

- RV accidents

- Semi-truck 18 wheeler accidents

- Side-impacts

- Taxicab accidents

- Uber, Lyft accidents

- Train accidents

Baker Street Funding provides accident financing for some of the following bodily injuries.

All victims with bodily injuries caused by traffic, air, or water-related negligence are welcomed to apply.- Anoxic Brain Injury

- Amputation Compensation

- Broken Bones and Fractures

- Catastrophic Injuries

- Cerebral Palsy

- Compression Fractures

- Coup Countrecoup Injury

- Crush Injuries

- Diffuse Axonal Brain Injuries

- Erbs Palsy

- Fire and Burn Injuries

- Forceps Birth Injury

- Internal Bleeding

- Knee Injuries

- Laceration

- Loss of Consortium

- Loss of Sight Hearing and Senses

- Neurological Disorders

- Organ Damage

- Orthopedic Injuries

- Scarring and Disfigurement

- Slipped or Torn Discs

- Soft Tissue Injuries

- Spinal Cord Injuries

- Trampoline Park Injuries

- Vertebrae Fracture